iowa income tax withholding calculator

As an employer in Iowa you have to pay unemployment insurance to the state. Iowa income tax calculator 2021.

Iowa Or Ia State 2022 Income Taxes Can Be Filed With Irs Return

Appanoose County has an additional 1 local income tax.

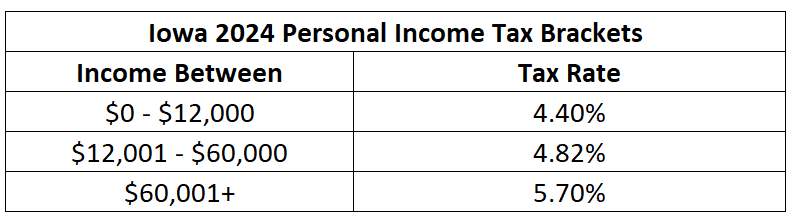

. 15 Tax Calculators 15 Tax Calculators. Withholding Tax Information. Income Withholding for 2022.

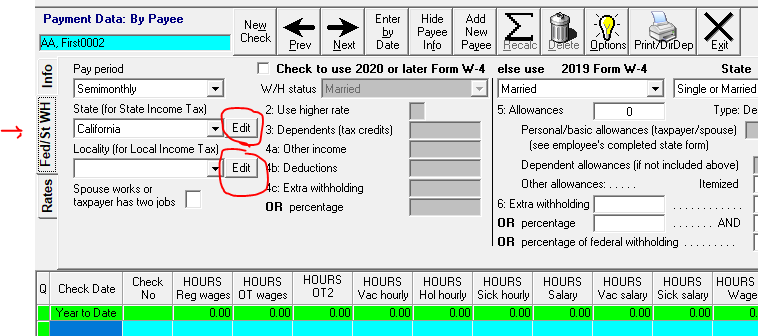

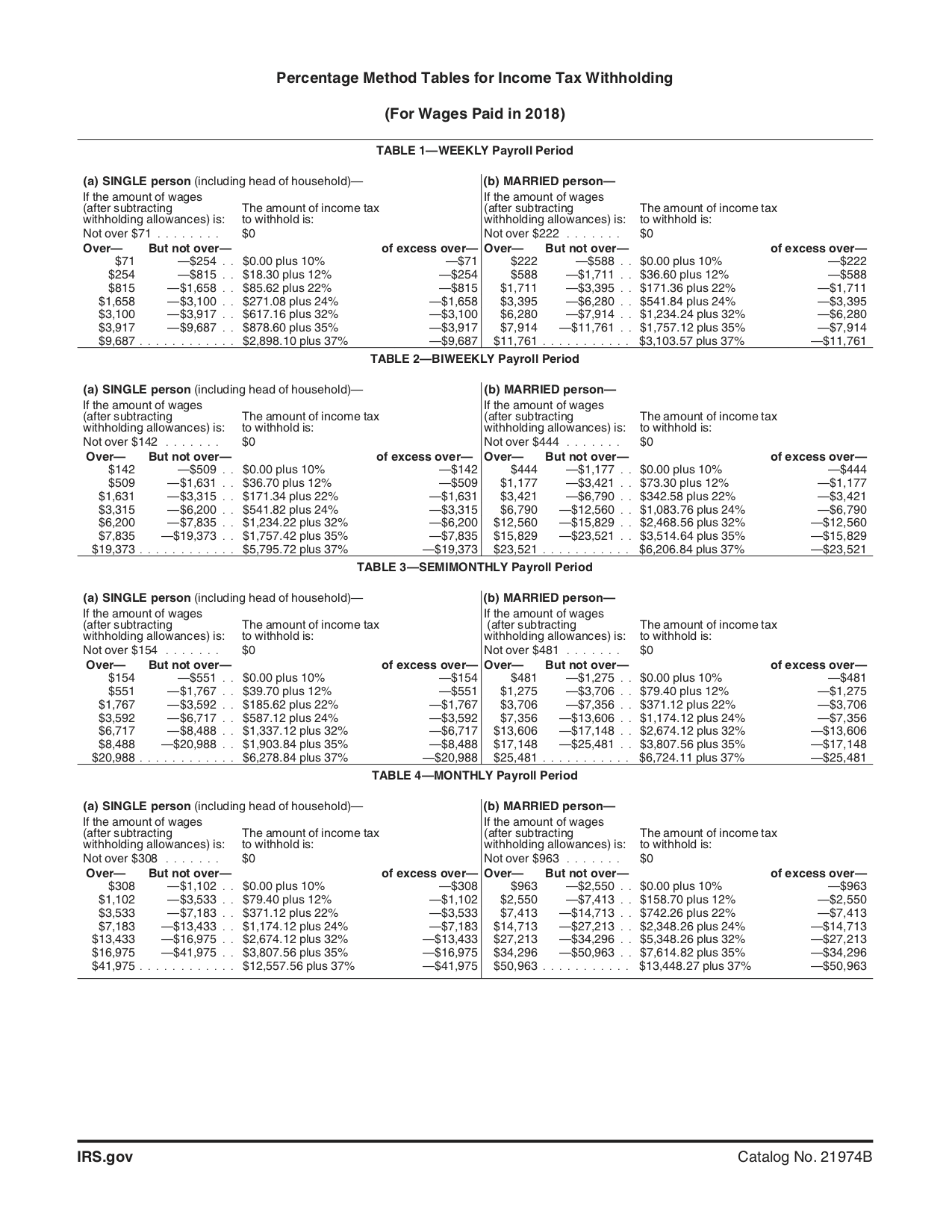

Your average tax rate is 1198 and your marginal tax rate is 22. The next step is to calculate the income tax withholding which is computed under either of the following methods. Fill Out a Form W-4 - Basic.

Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck. This calculator assumes that none of your long-term capital gains come from collectibles section 1202 gains or un-recaptured 1250 gains. The amount of income tax your employer.

New job or other paid work. Individuals earning less than 1743 per year will face a flat tax rate in 2022. These types of capital gains are taxed at 28 28.

Electronic Reporting of Wage Statements and Information. See the most paycheck friendly places. This results in roughly 7736 of your earnings being taxed in total although depending on.

2021 Tax Year Return. The Department updates withholding formulas and tables each year because individual income tax brackets are indexed annually to adjust for inflation. Iowa income tax withholding is applied to the same wages and compensation to which federal withholding applies.

Iowa income tax calculator 2021. The 2022 rates range from 0 to 75 on the first 34800 in wages paid to each employee in a. Adjust Form W-4.

When to Check Your Withholding. Check your tax withholding every year especially. But it also has one of the lowest bottom rates.

Certain payments made by the employer into employee retirement plans. The Federal or IRS Taxes Are Listed. IDR has issued new income withholding tax tables for 2022 including an updated withholding calculator.

This results in roughly 7736 of your earnings being taxed in total although depending on. For individuals who make more than that the Iowa income tax rate will be 68. Learn More About Iowa Withholding.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. The amount of income tax your employer. Withholding Agents and Estimated Tax.

EasyPay Iowa Wheres My Refund. Iowa Income Tax Calculator 2021. W-4 Form Basic - Create Sign Share.

The Iowa Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year. The winner pays the withholding tax to the payer. When you have a major life change.

Paycheck Calculators by State. View 2021 Withholding Tax Tables. However for those who make.

The states income tax system features one of the highest top rates which at 853 ranks among the highest states. Nonresidents whose Iowa income is other than wages can choose to have Iowa income tax withheld or to pay estimated income tax. The Iowa State Tax Calculator IAS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202324To estimate your tax return for 202324 please select the 2023 tax.

Form W-4 Tax Withholding Form W-4 Tax Withholding.

Iowa W4 Form 2011 Fill Out Sign Online Dochub

Withholding Tax Rate Tables Cfs Tax Software Inc

Paycheck Calculator Take Home Pay Calculator

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

The Treasury Department Just Released Updated Tax Withholding Tables That Will Change Your Paycheck Mother Jones

2022 Income Tax Withholding Tables Changes Examples

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Idr Issues New Income Withholding Tax Tables For 2022 Mix 107 3 Kiow

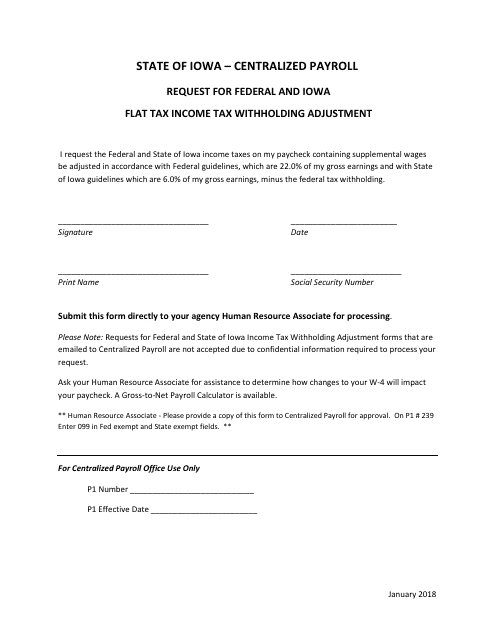

Iowa Request For Federal And Iowa Flat Tax Income Tax Withholding Adjustment Download Printable Pdf Templateroller

Iowa Income Tax Calculator Smartasset

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Iowa Trucking Owner Sentenced In 1 4m Payroll Tax Scheme Freightwaves

How To Calculate Iowa Income Tax Withholdings

Taxuni Personal Finance And Tax University

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax